A property assessment is the process of estimating the market value of a property for taxation purposes. The assessed value of a property impacts the amount of municipal tax, provincial education tax, and seniors lodge tax that is levied on a property.

Assessment Survey

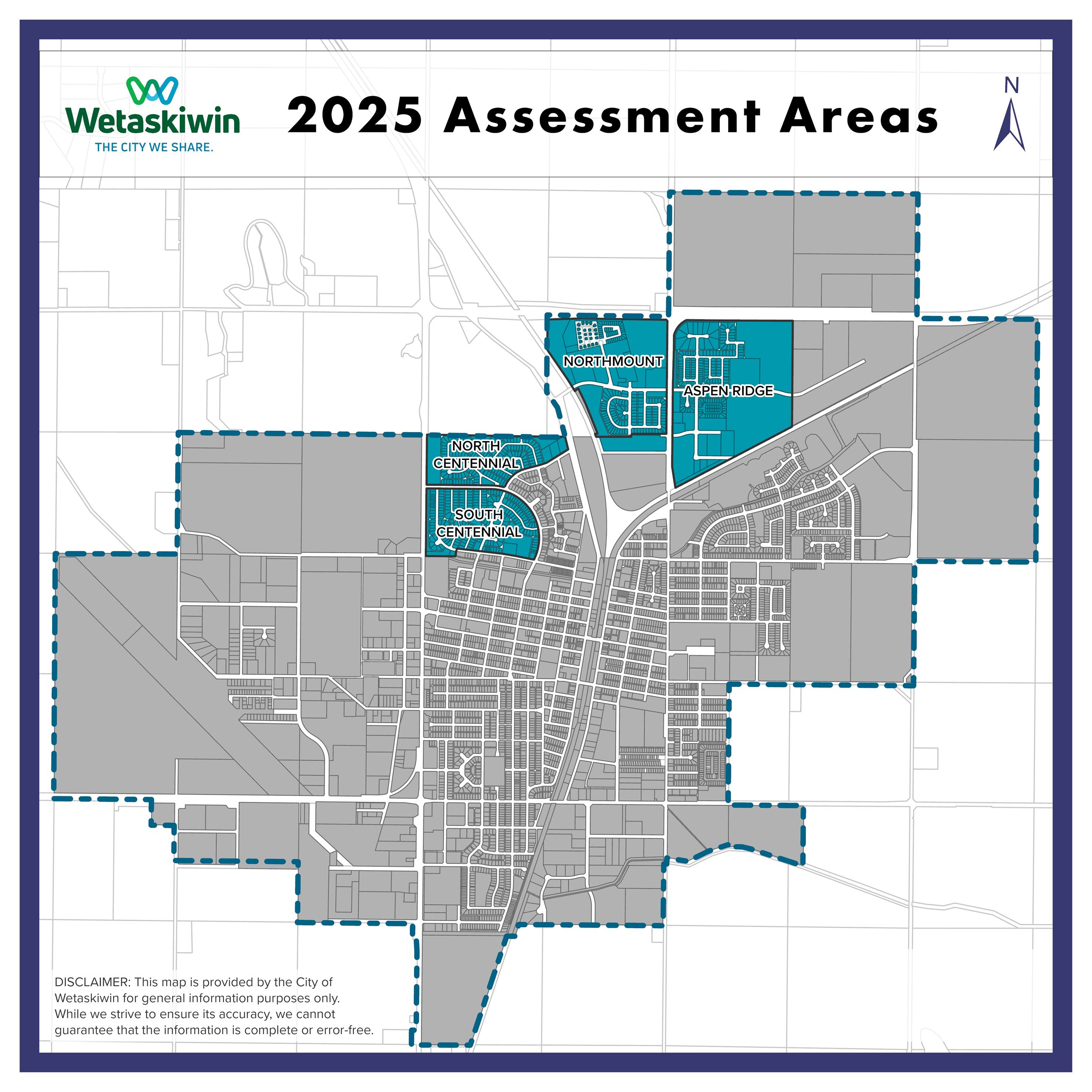

An assessment review is now underway for some Wetaskiwin neighbourhoods. Accurate Assessment Group Ltd. (AAG) has been contracted by the City of Wetaskiwin and is acting as its agent to complete the 2025 general assessment for the 2026 tax year. In conjunction with the survey, AAG will be performing inspections in the reinspection area over the coming months. AAG personnel may be spotted in marked vehicles collecting additional information and pictures as needed.

Assessment Survey FAQs

What is a property assessment?

What is the deadline to complete the survey?

Letters to affected properties were mailed out on Friday, March 14, 2025, and property owners are being asked to respond to the survey no later than Wednesday, May 14, 2025, to ensure their assessment is accurate.

Assessments are regularly reviewed to ensure all property assessments in the City of Wetaskiwin are fair and equitable. The information collected will confirm existing conditions or updates to your property, which helps the City maintain an up-to-date assessment for tax purposes. The information is collected under the authority of the Municipal Government Act, Section 294 and 295.

Which parts of the city are being assessed this year?

Assessments are completed as part of a five-year reassessment cycle. Only 20 per cent of homes are required to complete the survey in a given year. The 2025 assessment survey will cover the following neighbourhoods:

- North Centennial

- South Centennial

- Northmount

- Aspen Ridge

There are three ways to complete the survey:

- Online: this is the preferred method. Use the following web address, roll number, and survey key listed below:

Address: http:vps.camalot.ca/rfi

Roll number: e.g., 123456 (specific to each property)

Survey key: e.g., 1111 (specific to each property) - Scan and email: complete both pages of the survey that was delivered with your notice letter, scan, and email it to kurt@aag-gis.om with the subject line “Residential RFI.”

- Drop off: complete both pages of the survey that was delivered with your notice letter and drop it off at Wetaskiwin City Hall (4705 50 Avenue), labelled “Attn: Taxation, or Kurt Hartman."

If your property is being assessed this year, you will have received a letter and survey. Click the links to view samples of these documents. The survey sample is for a single-family dwelling; your actual questionnaire may differ slightly, depending on the property type. If you have any further questions about the assessment survey, please contact Kurt Hartman at kurt@aag-gis.com or call 1.877.438.2305.

Contact Us

Taxation

4705 50 Avenue

Box 6210

Wetaskiwin, Alberta

Phone: 780.361.4400

Email: taxation@wetaskiwin.ca

Hours

Monday to Friday

8:30 a.m. to 4:30 p.m.